Many Restaurants May Be

Liable for Damages

Many restaurants fail to comply with wage and hour labor laws, often overlooking critical aspects of employee time tracking, overtime calculations, and tip handling. These gaps in operations expose restaurant owners to significant legal and financial liabilities. When employee hours aren't properly recorded, or when wage laws are misunderstood or ignored, restaurants can find themselves facing costly lawsuits.

In the fast-paced environment of the restaurant industry, it’s easy to miss details like overtime calculations or ensuring that employees receive fair wages in compliance with labor laws. However, the consequences of such oversights can be severe. Let’s look at a real-world example:

A restaurant server worked 60 hours a week, earning tips that averaged $200 a day, which totaled $62,400 annually. The server had no base salary, relying entirely on tips for income. After one year of employment, the server sued the employer for unpaid wages. While tips are an important part of a server’s income, they cannot replace wages entirely. Even with an agreement, federal law allows only a portion of tips—around $2–$3 per hour—to count toward wages. The court would calculate the owed wages as follows:

- Hourly Wage: $16/hour

- Overtime Wage: $24/hour (1.5x hourly)

The minimum weekly salary should have been:

- Base Pay: 40 hours @ $16/hour = $640

- Spread of Hours: 6 hours @ $16/hour = $96

- Overtime Pay: 20 hours @ $24/hour = $480

- Total Weekly Pay: $640 + $480 + $96 = $1,216

- Annual Pay: $1,216 x 52 weeks = $63,232

Since the server earned $62,400 in tips, the employer still owed the server $63,232 in wages. Because of the wage violation, the court may double the amount owed, bringing the total to $125,632. With 9% annual interest over 5 years ($56,534.40), the total becomes $182,166.40.

"Adding attorney fees (typically ⅓ of the total compensation), the final cost to the employer could reach around $242,888.53."

This example shows how failing to pay employees fairly, even when tips seem to cover their income, can backfire on restaurant owners. Many restaurants do not track hours accurately, fail to account for overtime, or improperly handle tips. These operational gaps can lead to lawsuits that result in steep financial penalties.

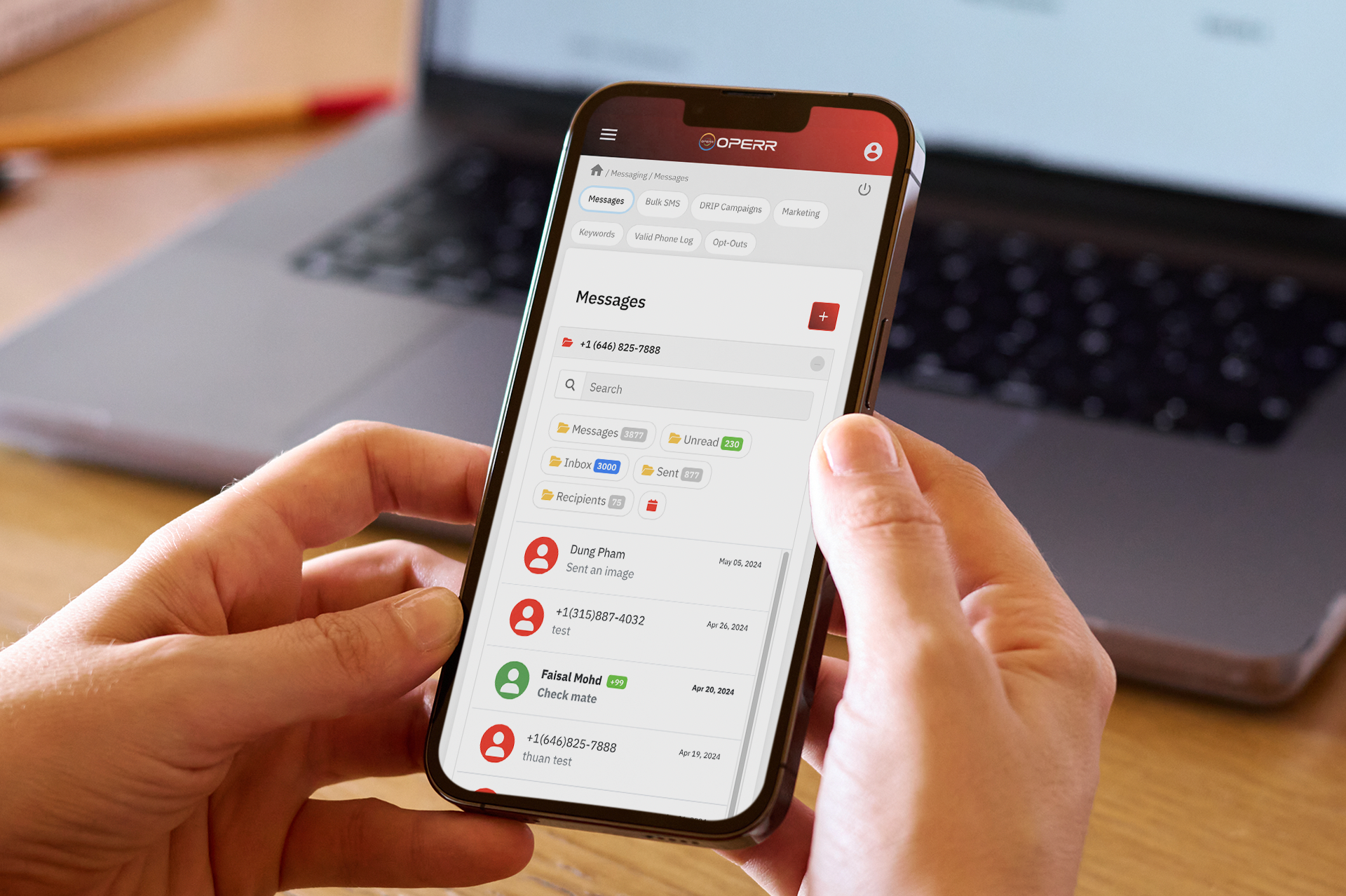

Restaurants must maintain detailed and accurate records of employee hours, ensuring they comply with labor laws regarding wages, breaks, and overtime. A reliable time-tracking system, such as a punch clock, can help prevent these issues, ensuring that employee hours are recorded correctly and wage laws are adhered to. Proper documentation of tips, combined with accurate payroll processes, will protect both employees and employers from potential disputes.

In conclusion, neglecting to track employee hours and wages accurately in the restaurant industry can lead to severe legal consequences. By implementing robust time-tracking systems and adhering to wage laws, restaurant owners can avoid costly lawsuits and foster a fair working environment.